Arizona Deal Latest Sign of Booming Demand for Sites to Power AI

This article originally appeared in the Wallstreet Journal on August 28.

Tract’s $136 million purchase of 2,100-acre site near Phoenix represents the next big thing in land speculation: finding sites to power a new wave of data centers

The rise in artificial intelligence is fueling a new breed of speculator: those focused on buying and selling land for power-hungry data centers that serve as the backbone for AI, cloud computing and other internet technologies.

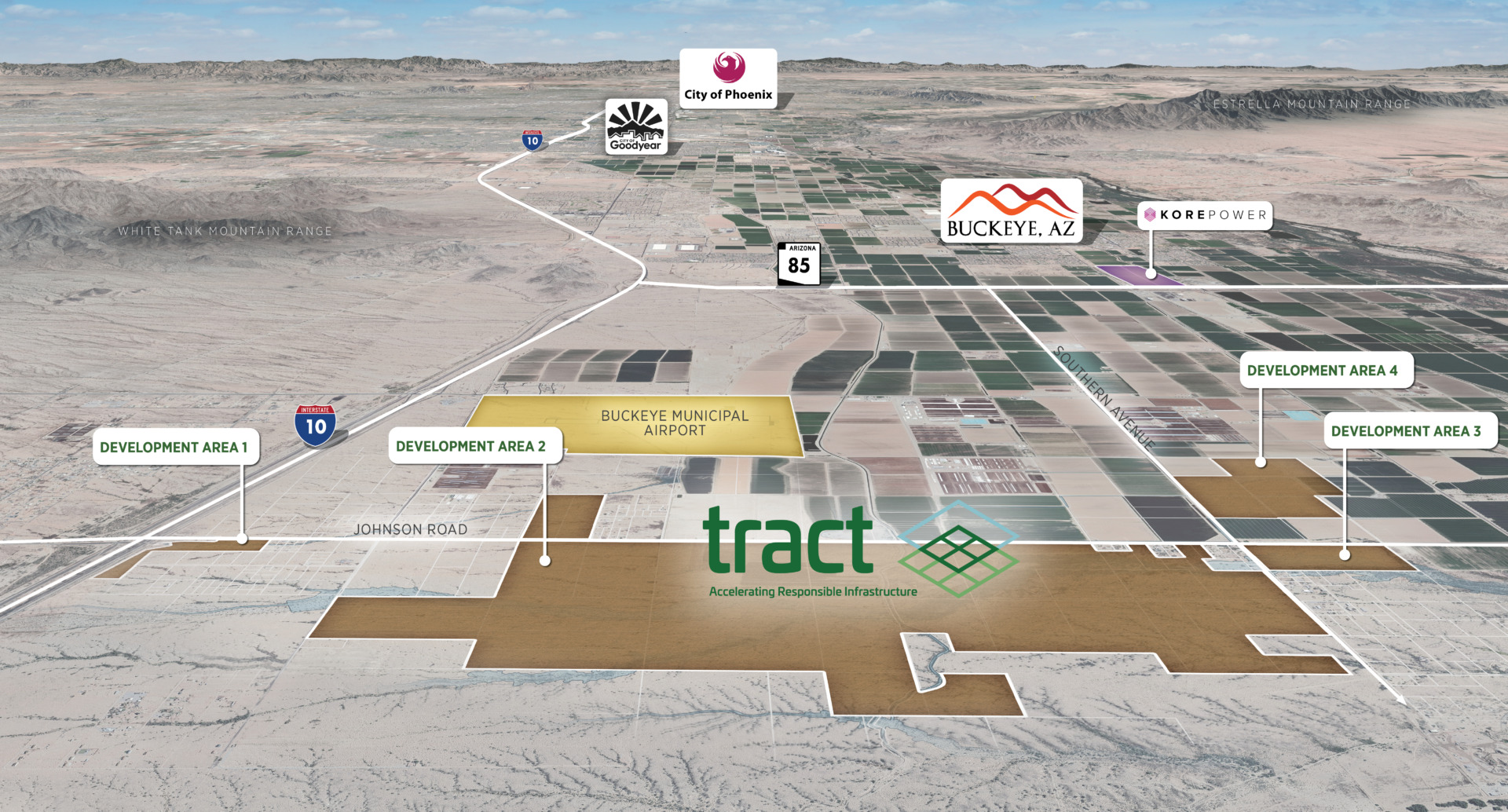

In the latest deal, a startup data-center land-development fi rm this week paid$136 million for a 2,100-acre site outside of Phoenix with a 15-year plan to convert it into one of the nation’s largest data-center complexes. Denver-based Tract, which owns or is in contract to buy over 20,000 other acres of U.S. land, says the agricultural and undeveloped land in Buckeye, Ariz., ultimately could support $20 billion worth of data-center development. That fi gure doesn’tinclude the servers that would populate the buildings.

“Ten years ago a company would go out and buy 15 to 20 acres and build a datacenter,” said Graham Williams, chief investment officer of Tract, which was formed in 2022 by former executives of Level 3 Communications, a Colorado-based company that helped build the Internet network. “Now we’re talking about 500- to 1,000-acre campuses.”

Tract buys raw land well-located for data centers and obtains the necessary zoning and permits for projects. Tract also develops the infrastructure on the sites, adding roads, water, sewers, power and fiber. Tract then aims to sell the land to data-center developers or owners of so-called hyperscale data centers like Amazon.com, Google and Microsoft. Tract typically spends $100 million to $150 million on a site to prepare it for sale, Williams said.

Tract purchased the Buckeye land from another land speculator, Arizona LandConsulting, which paid $40 million for the land in 2022. Anita Verma-Lallian, the founder of that fi rm, said when she acquired the site she thought she could sell it for a range of uses, including manufacturing, warehousing and data centers.

These days Arizona Land is “acquiring sites moving forward with just datacenters in mind,” Verma-Lallian said. “Things have changed.”

AI has turbocharged demand for data centers because it requires far more energy capacity than other, more traditional technologies. Data centers throughout the U.S. currently off er about 6.7 gigawatts of capacity, excluding those owned and occupied by one tenant, according to CBRE Group, a commercial real-estate services firm.

Facilities with more than 4.5 gigawatts of capacity will be under construction by next year, CBRE said. One gigawatt is enough energy to power about 750,000homes.

Major data-center markets include Northern Virginia, Atlanta, Phoenix and Silicon Valley. But increasingly, development is spreading to secondary markets, including northern Indiana, Idaho, Arkansas and Kansas, according to CBRE.

Data-center development has recently run into a rising number of obstacles. Some community groups oppose them because they can be noisy eyesores that compete with residential and commercial uses for power and other infrastructure.

The huge amount of power needed by some data centers is also becoming harder to get. Data-center developers acknowledge that it isn’t clear whether new electrical production in the future will be able to meet the needs of planned data-center projects, especially because developers and tenants increasingly want power to come from renewable sources like wind and solar.

“Everyone is looking for sourcing renewable energy adjacent to data-center sites,” said Gordon Dolven, director of Americas Data Center Research for CBRE. “That is now the crown jewel.”

The Buckeye City Council this month unanimously approved an agreement with Tract to move ahead, with local officials citing new jobs and the development’s contribution to the city’s tax base.

Tract is currently working with Arizona Public Service, the utility that serves the Phoenix region, to make sure power will be available to meet the future needs of the project. “We are deep into the engineering process right now,” Williams said.